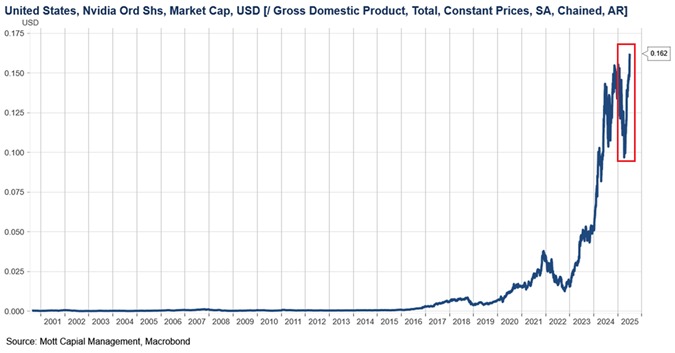

https://medium.com/@hrnews1/the-value-of-nvidia-now-exceeds-an-unprecedented-16-of-u-s-gdp-ede4b541b24c Sixteen percent of GDP. Think about that number.

The United States has tethered 16% of its entire economic output to the fortunes of a single company. Not an industry. Not a sector. One company. NVIDIA.

This isn’t diversification. It’s not even speculation. It’s national self-delusion dressed up as innovation.

America has done this before. We worshiped General Motors until it collapsed. We inflated the dot-com bubble until it burst. We built an entire financial system on subprime mortgages until 2008 taught us otherwise. We learned nothing…. NVIDIA’s Unchecked Dominance

NVIDIA makes graphics processing units. They’re very good at it. Their chips power AI models, crypto mining operations, and cloud datacenters. The company’s market capitalization has surged to over $5 trillion.

Wall Street cheers. Politicians brag about American technological superiority. NVIDIA’s CEO becomes a rockstar.

But here’s the truth: concentrated market dominance is not strength. It’s fragility masquerading as power.

NVIDIA controls between 80% and 95% of the market for AI chips used for training and deploying models. Their H100 and A100 processors are the gold standard for training large language models. Every major tech company — Microsoft, Google, Amazon, Meta — depends on their hardware.

This isn’t resilience. It’s a single point of failure with a stock ticker.

Revenue concentration tells the story. NVIDIA’s datacenter segment accounts for over 88% of total revenue. Remove AI hype from the equation and you’re looking at a company propped up by speculative frenzy, not diversified industrial strength. The Dangerous Over-Leverage of the U.S. Economy

Sixteen percent of GDP.

Let me say it differently: If NVIDIA stumbles, America doesn’t just lose a tech darling. It loses jobs, investments, pension funds, and the entire AI narrative Wall Street has been selling.

The ripple effects would be catastrophic. Tech slowdown. Financial contagion. Investor panic. The kind of systemic shock that makes 2008 look like a practice run.

And what’s America’s backup plan? There isn’t one.

We’ve bet the economy on corporate hubris rather than building diversified industrial capacity. We’ve confused market capitalization with national security. We’ve treated stock prices as a measure of geopolitical strength. It’s reckless. It’s stupid. And it’s quintessentially American.

No other advanced economy would tolerate this level of concentration. Germany doesn’t pin 16% of its GDP on Siemens. Japan doesn’t hinge its future on Toyota. Even China, for all its centralized planning, spreads risk across multiple state champions.

But America? We put all our chips on one chipmaker and call it genius. Supply Chain Fragility and Geopolitical Shortsightedness

NVIDIA doesn’t manufacture its own chips. Taiwan Semiconductor Manufacturing Company does. TSMC produces an estimated 90% of the world’s super-advanced semiconductor chips, and more than 90% of the most advanced chips globally are manufactured in Taiwan.

Taiwan. An island 100 miles from mainland China. A territory Beijing considers its own. The most geopolitically volatile piece of real estate on the planet.

This is where America has decided to anchor its technological future.

TSMC’s most advanced facilities are in Hsinchu and Tainan. If China moves on Taiwan — through blockade, invasion, or economic coercion — those fabs go offline. NVIDIA’s supply chain evaporates. America’s AI ambitions collapse overnight.

And China knows this.

Beijing is pouring resources into semiconductor self-sufficiency. SMIC, Huawei, and other Chinese firms are reverse-engineering NVIDIA’s architecture, with Huawei’s Kirin 9000S processor — produced in SMIC factories — providing tangible proof that China can produce advanced chips locally despite embargoes.

Analysts project China will achieve a true 5nm-based chip by 2025 or 2026. SMIC is approximately a handful of years behind TSMC in process technology.

Five years. That’s the gap between American dominance and Chinese parity.

Export controls won’t save us. Sanctions won’t stop reverse engineering. The U.S. can restrict NVIDIA from selling advanced chips to China, but it can’t prevent Chinese engineers from studying, replicating, and eventually surpassing American designs.

History is littered with technological monopolies that thought they were untouchable. Britain dominated textiles until America stole the designs. America led in consumer electronics until Japan refined the process. Japan ruled semiconductors until Korea and Taiwan built better fabs.

Overconfidence breeds catastrophe. Always has. Always will. Market Myopia and Investor Complacency

NVIDIA’s price-to-earnings ratio has fluctuated wildly, hitting levels that would make even dot-com speculators blush. At its peak, the company traded at over 70 times earnings.

This isn’t valuation. It’s religion.

Investors assume AI demand is infinite. They believe NVIDIA’s dominance is permanent. They think American tech exceptionalism is a law of nature rather than a temporary advantage.

They’re wrong.

China’s chip industry is advancing faster than Western analysts predicted. Reports indicate Chinese companies are achieving 5nm chip production using deep ultraviolet lithography without access to extreme ultraviolet equipment.

The gap is closing. And when it closes, NVIDIA’s moat disappears.

American investors are complacent. They see NVIDIA’s stock price and assume supremacy. They ignore competitive threats until it’s too late. They confuse market hype with sustainable advantage.

It’s the same myopia that convinced investors pets.com was worth billions. The same delusion that made Enron look invincible. The same arrogance that inflated every bubble in American financial history.

Where is America’s industrial policy? Where’s the strategic planning? Where’s the diversification?

Nowhere.

Washington reacts to crises. It doesn’t prevent them. The CHIPS Act allocated $52 billion for semiconductor manufacturing — a pittance compared to the scale of the problem. It’s a band-aid on a hemorrhage.

Meanwhile, China created the China Integrated Circuit Investment Industry Fund to channel an estimated $150 billion in state funding to support domestic industry. South Korea and Taiwan have invested hundreds of billions more.

America is being outspent, outplanned, and outmaneuvered. And yet, policymakers still assume tech dominance is our birthright.

Anti-trust enforcement is toothless. Strategic planning is non-existent. Industrial diversification is treated as anti-market heresy.

The result? America has a “too-big-to-fail” tech company that nobody wants to regulate, nobody wants to challenge, and everybody assumes will last forever.

We’ve been here before. AT&T. IBM. Microsoft. All seemed invincible until they weren’t.

The difference now? NVIDIA isn’t just a monopoly. It’s a systemic risk. And nobody in Washington seems to care.